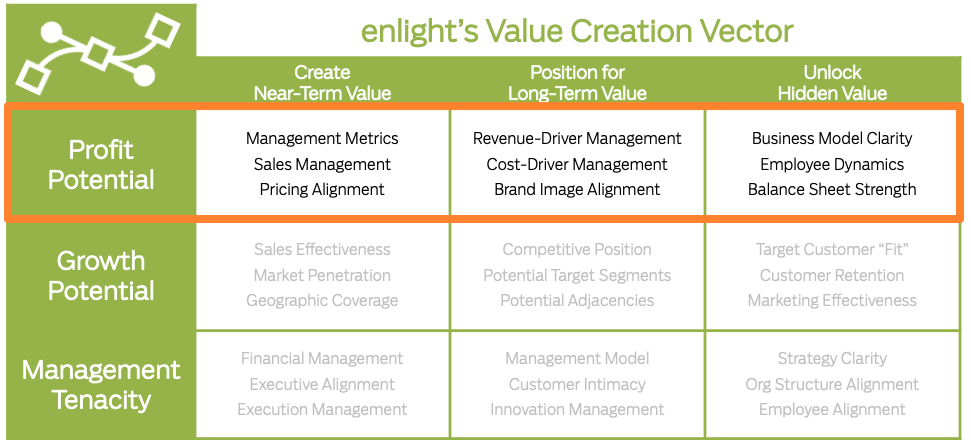

In my last post about the Value Creation Vector, I provided an overview of the tool and how it can drive focus, prioritize actions and deliver results for companies. Today, I’m going in more detail about the first lever: Profit Potential.

I wrote this in the last post, but it bears repeating:

Profitability is the ultimate barometer of a company’s health. Optimizing profitability is the easiest way to assure long-term viability. Job one is to assess the company’s potential to improve profitability. Even if growth is the ultimate goal, why grow something that’s mediocre (or worse), when you can grow something that’s healthy and profitable? I know, I know, improving what you already do may seem boring compared to shiny new objects (growth! innovation! acquisitions!) that are often hard to resist. But, I’ve yet to encounter a company that has maxed-out its existing Profit Potential.

So, what do we do we consider when we assess a company’s profit potential? We look at several profitability factors that Create Near-Term Value, Position For Long-Term Value and Unlock Hidden Value.

Create Near-Term Value

We start the assessment with the factors that impact near-term profit potential because small changes in these factors can have significant and immediate impacts on profitability. These factors practically generate free money for companies. How can that be bad?

The factors we consider are:

1. Management Metrics – What are the key metrics the management team uses to monitor company performance and drive decision-making?

We want to understand if the metrics are:

- Strategically Aligned

- Internally Consistent

- Comprehensive

- Visible and Transparent

2. Sales Management – How effectively is the sales team managed to sell current products or services to current customers and potential customers?

We want to understand if the sales team has:

- Sufficient Customer Coverage

- Appropriate Sales Metrics

- Effective Sales Incentives

- Accountability for Discounting

3. Pricing Alignment – Are current prices, pricing strategy and day-to-day process pricing management aligned with each other – and with the company’s overall strategy?

We want to understand if current pricing is set to maximize value creation by assessing:

- Pricing Calibration: Too High, Too Low, On-Target

- Cost Calibration: Accuracy, Completeness

- Discounting Frequency and Magnitude

- Current Price-Setting Methodology

Position For Long Term Value

By definition, factors that help a company capture long-term value require more time, first to determine the appropriate action and, then, for those actions to impact profitability. In addition to improving profit potential, optimizing these factors makes the company more proactive, more productive and more resilient over the long-term.

The factors we consider are:

1. Revenue-Driver Management – Does the company understand what drives revenue and apply that knowledge to day-to-day decisions?

We want to understand if the management team:

- Understands Revenue Drivers

- Assesses Revenue Drivers With Metrics

- Ensures Metrics Are Transparent

- Maintains Accountability For Revenue Drivers

2. Cost-Driver Management – Does the company understand what drives costs and apply that knowledge to day-to-day decisions?

We want to understand if the management team:

- Understands Cost Drivers

- Assesses Cost Drivers With Metrics

- Ensures Metrics Are Transparent

- Maintains Accountability For Cost Drivers

3. Brand Image Alignment – How well is the brand aligned with day-to-day operations?

We want to understand if the company has achieved:

- Brand Honesty

- Marketing Material Alignment

- Competitive Differentiation

- Sales Alignment

Unlock Hidden Value

The factors that unlock hidden value are often overlooked and not necessarily intuitive. However, they make the company stronger and improve profit potential.

The factors we consider are:

1. Business Model Clarity – Has leadership helped employees understand how the company makes money so day-to-day decisions contribute to improved profit potential?

We want to understand if the entire company understands the reality and importance of:

- Revenue Drivers

- Cost Drivers

- Individual Impact on Results

- Collective Impact on Results

2. Employee Dynamics – Does the company understand how important employees are to driving value and are they effectively managing the workforce to reflect their importance?

We want to understand if the company is assessing and managing:

- Culture Alignment

- Workforce Strategy Alignment

- Comp and Benefits Alignment

- Employee Retention

3. Balance Sheet Strength – Has the company managed the balance sheet to support profitability and cash flow?

We want to understand the ability to improve profit potential through:

- Accounts Receivable Days

- Accounts Payable Days

- Fixed Asset Utilization

- Leverage Ratios

Let’s say it one more time: Profitability is the ultimate barometer of a company’s health. The most successful companies get their existing house in order before seeking expansion. No matter your industry, systematically addressing the factors that impact Profit Potential will position your company for successful growth.