enlight blog

We’ve never had a crystal ball

Uncertainty isn’t new, but now we’re navigating it day-in, day-out. How can you and your business pivot to permanently adapt strategic and financial planning to better reflect an explicitly uncertain reality?

What’s the difference between a responsibility and a burden?

Do your employees think of their work as a responsibility or a burden? How does your answer affect your culture, employee retention or financial performance? And how does it impact the emotional well-being of your employees?

Your silence will not protect you

I’ve been trying to understand white privilege and my role in institutional racism for over a decade. But I’ve kept that work “on the side,” separate from my day-to-day business. That changes today.

Your business needs a hero…are you up to the task?

The COVID-19 outbreak is one of those defining moments. Ask yourself – are you a coward or a hero? The good news is if you don’t like the answer, you can take action to change.

Market Insight: Why You’re Doing It Wrong And How To Get It Right

As we discussed in our market insights overview blog, customers are the only people who are consistently putting money into your business. Understanding how they use your products and services to create value for their businesses is fundamental to your company’s growth and prosperity.

The Customer Is Always Right: Why Market Insight Should Shape Your Business

You want to grow your successful business, or maybe you’re falling behind the competition. Whether you’re a market leader or struggling to keep up, quality market insights can help improve your returns.

10 Rookie Mistakes Every Family Office Should Avoid

We’ve seen deals – and even families – fall apart when thanks to a direct investment gone bad. While direct investment can be an exciting and lucrative tool to build and maintain your family’s wealth, if you’re just starting out, you’ll want to avoid these rookie mistakes.

Got Discipline? You’ll Need It For Your Family Office Investments To Pay Off

When you hear the word discipline, you may think of world-class athletes or Nobel-winning physicists – or you may think of the principal’s office. Whatever pops into your head, it’s probably not the execution of your family office’s investment strategy – and that’s one reason even the best strategies are often unsuccessful.

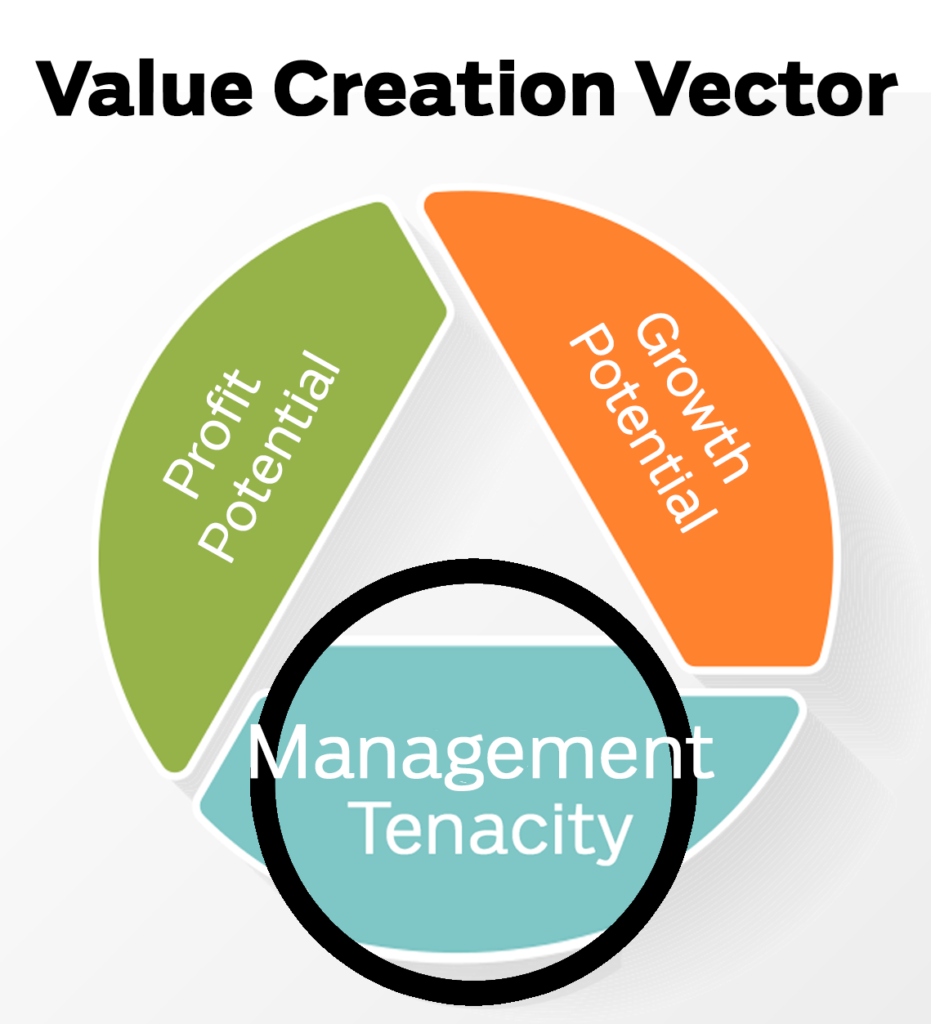

Does Your Management Team Have The Tenacity To Get The Job Done?

In our last post about the Value Creation Vector, we dug into the second lever, Growth Potential. Today we’re going to look at the third lever: Management Tenacity. Sadly, this lever is typically least interesting to management, even though it’s often the easiest way to generate value.

Right Here, Right Now: Crafting A Successful Family Office Investment Strategy and Assembling The Team To Support It

In our last article, we detailed the first two factors for successful family office direct investment: Right Experience and Right Reasons. Today, we’ll cover the next two factors: Right Strategy and Right Team. You can see the complete list in our intro post on the topic.