For nearly 15 years, we have been fortunate to serve great clients. Although each situation is unique, most clients seek to grow their company or improve their profitability – or achieve both results at once. However, at the beginning of most engagements, the client is often focused on growing the business but doesn’t have a handle on their profitability – or their ability to improve it. Or, perhaps they’re having an internal debate about the importance of growth v. cost cutting v. operational efficiencies. Or, maybe they just don’t see a clear path from where they are to where they want the business to be in the future.

Solving this quandary is where we deliver value. It may sound simple, but helping our clients address the right questions at the right time is one of our differentiating skills. What are we trying to accomplish? What are the most important questions to answer first? What data do we need? How can we eliminate irrelevant noise? What questions come next?

Order Matters

I think of sequencing our client engagements much like the concept of “Order of Operations” in math. Remember that from middle school? (Maybe you learned it in elementary school…I went to public school in rural Kentucky, so cut me some slack!) The image at the left provides a quick refresher in case you’ve blocked out the details.

Like solving a complex equation, successful consulting engagements pace the questions so clients address the right questions or decisions in the right order. Trying to address everything at once or addressing them out of order can be paralyzing. All too often we find clients – and their executive teams – muddling through questions and decisions, creating a continuous loop of uncertainty. Or worse, they’re stuck in a debate where the loudest, most powerful voice in the room wins, regardless of what is actually best for the business.

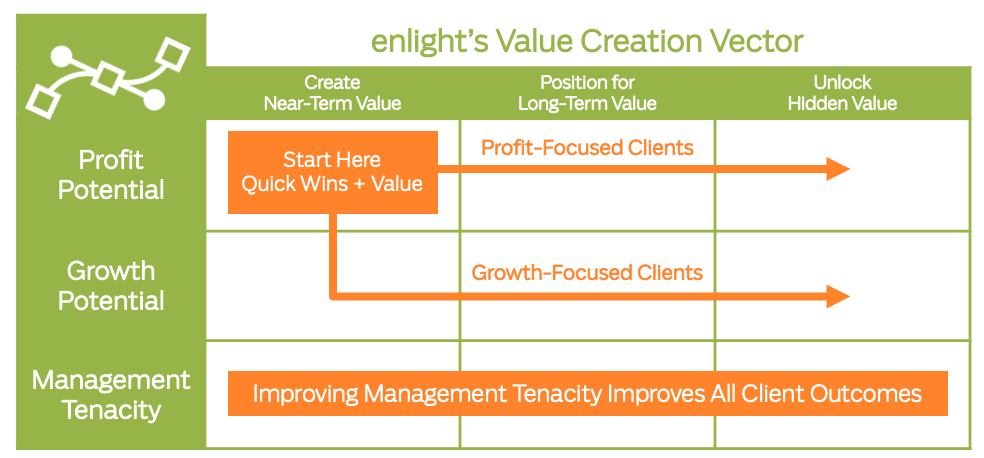

We provide a structured, efficient approach to work through the right stuff at the right time. Laying out an appropriate order of operations simplifies the work. You can almost hear the collective exhale as client teams sigh in relief. One of the tools we use is the Value Creation Vector. This tool helps us zero-in on the most important factors for each client, depending on their situation and needs. The Value Creation Vector isolates factors that address profitability, growth and effective management and relates them the opportunity for value creation.

Why “Value Creation Vector”?

We developed the Value Creation Vector tool to capture an effective order of operations for helping clients drive real results to the bottom line. We focus on the right questions in the right order, taking the client’s goals and current performance into account. We call it the Value Creation Vector because it assesses both the magnitude and direction of the opportunity.

Examples of real-life client dilemmas we’ve encountered:

Acquisition Allure: We want to grow, and we need a West Coast presence, so let’s acquire ABC company. They seem to be successful, and it would be so easy to make a deal.

Pricing Problems: We want to grow sales, so we’re going to lower the price of our most popular products.

Chicken & Egg Growth: The VP of Sales says he can move lots of new products if only the VP of Manufacturing will figure out how to make them. The VP of Manufacturing wants to build a plan for new products before they try to sell them, and thinks the sales team should focus on increasing volume for existing products.

With the Value Creation Vector, we quickly assess the current state to determine where to start and what to do next.

The model includes three levers: Profit Potential, Growth Potential and Management Tenacity. Each lever captures key elements that create value over time.

Lever 1 | Profit Potential

Profitability is the ultimate barometer of a company’s health. Optimizing profitability is the easiest way to assure long-term viability. Job one is to assess the company’s potential to improve profitability. Even if growth is the ultimate goal, why grow something that’s mediocre (or worse), when you can grow something that’s healthy and profitable? I know, I know, improving what you already do may seem boring compared to shiny new objects (growth! innovation! acquisitions!) that are often hard to resist. But, I’ve yet to encounter a company that has maxed-out their existing Profit Potential.

Lever 2 | Growth Potential

Once you’re comfortable that your company is performing at its peak, attention can turn to growing the “machine.” Assessing growth potential in a structured way helps focus energy first on why to grow – then where and how to grow. For example, all too often leadership is fixated on making an acquisition – sometimes they’ve even identified the specific company! – but they can’t articulate ‘why’ the move is good for the business. Acquisitions that don’t clearly support a company’s existing growth potential never live up to expectations and can ultimately destroy value.

Lever 3 | Management Tenacity

It’s safe to say no one has ever hired us to improve management tenacity. And, that’s a crying shame. This is where the low-hanging fruit abounds. Always. A few small tweaks to how the management team works have lasting impacts on financial performance, longevity and morale – all with little or no financial risk. Honestly, it doesn’t get much better than that.

In upcoming blog posts, I’ll outline how we use the Value Creation Vector to quickly get clients on the same page and on the right track.